Valued Customers:

Welcome to our first official crop report of the 2022 Pack Season. We can all attest to the fact that it’s been quite a year with disruptions in most commodities, the weather, and of course the economy. While we’ve had plenty of precipitation in the Northwest, we continue to experience long term drought conditions in California. Here in the Northwest, we received some of the latest snow and freezing temperatures in the last 40 years in April & May. This has not played out well for Bartlett pears, and even worse for cherries, our first pack of the year.

California Tomatoes

As mentioned above, lack of water and crop risk has been the biggest driver of many growers switching to less risky crops for the 2022 pack season.

Planted processed tomato acreage is projected at 234,000 acres, down from 245,000 acres in January. There have been reports of late plantings that may add to this, if season holds into October. Record high temperatures in March were followed by freezing temperatures in April, likely stressing yield per acre.

We believe, with irrigation, weather issues and alternative crop preference by growers (reduced tomato acreage) this year, the actual harvest will be somewhere between 11.2 and 11.5MM tons. This puts the tomato processors about 10-15% short of target, in a year where we’re starting with very low inventories from last year’s short crop. As of April 1, inventories were down 26.5% from the same time a year ago. Weather cooperating, most processors should be up and running in 3-4 weeks.

Learn more about the effects of the California water shortage here.

Pacific Northwest Fruit

Oregon/Washington has had an unusually cool and wet spring. As you can see by these photos, the growers have had to do everything in their power to protect orchards and generate some reasonable tons this season.

Cherries:

The cherry crop, generally harvested mid-June to mid-July had to withstand freezing temperatures, hail and even snow in April/May. Late rain and cool temperatures in recent weeks has caused smaller and split fruit, hail marks and frost rings in many orchards in Yakima and the Columbia River Gorge. We should know in the next 10 days, what we will actually be able to process, and like you, we wish we had better news and more inventory. As always, we will try to cover our current, loyal customers first and hope the season stretches out a bit with the late start.

Pears:

As with cherries, the unusual weather this spring has had a significant impact on the maturation of Bartlett pears. Many of the blossoms that were looking great the first weeks of April were lost to frost, ice and hail later in the month. What remained and has since blossomed has resulted in split sets of varying ripeness on many of the trees.

Undoubtedly, much of the fruit will size up smaller, further reducing a total fresh crop and likely processing tons by another 15%. With (we hope) the weather issues behind us, we should know where we stand in the next 2-3 weeks and forecast about 73.5K tons for Northwest processing tons.

This will necessarily mean a reduction in available inventories, at a time when carryover inventory is the lowest it’s been in years. Here again, we will work to fulfill our loyal existing customers first as we allocate what will likely be limited availability.

The negotiated price per ton for 22 pack is up from $355 in 2021 to $375 this year, or about a 5.6% increase.

Berries:

With the cool weather, the NW berry crop has also been delayed by 3-4 weeks. Many growers suggest the cooler, rainier weather up front may lengthen the season and end up providing more fruit. However, the increased moisture and dramatic temperature shifts could add to mold issues. Raspberries are at about 40% bloom with expected full bloom in next 1-2 weeks. Pollination, as with cherries and pears, has been low due to the cooler temperatures.

Blueberries were blooming ahead of raspberries and as such, lost more blooms and enjoyed less pollination during the cool spell. As temperatures warm, the bees and pollination accelerates. At this juncture we’d say crop looks to be average for berries this year.

Cranberries:

With the exception of some organic cranberries, we are almost sold out for the balance of 2022 and booking up fast for 2023 shipping season. We look to begin harvest October/November, depending on weather. Our fruit comes largely from the Bandon, Oregon region which has been growing cranberries since the 1890’s. This growing region is recognized globally for producing dark crimson color, superior nutritional value berries with amazing flavor and the quality looks not to disappoint this year. Cranberries are headed into full bloom this next week. Left is a photo from Bandon this week, showing a few berries already set along with some additional open bloom.

Northwest Packing continues to expand its industrial fruit offerings with an ever expanding list of concentrates, purees and essences. For more information, please contact Tyler Norris, National Fruit Ingredient Manager at TylerN@njfco.com

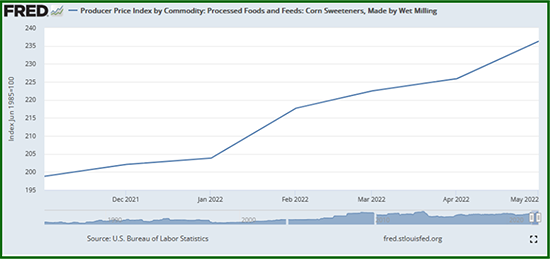

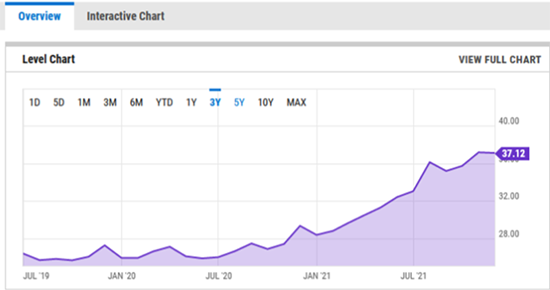

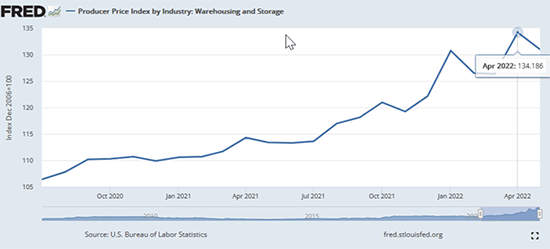

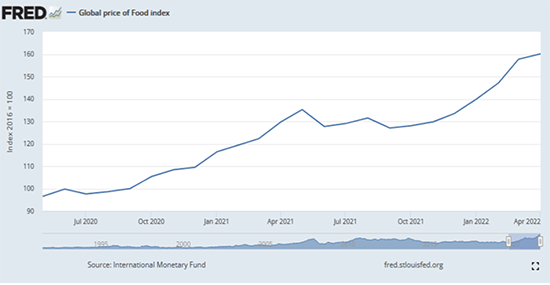

Costs:

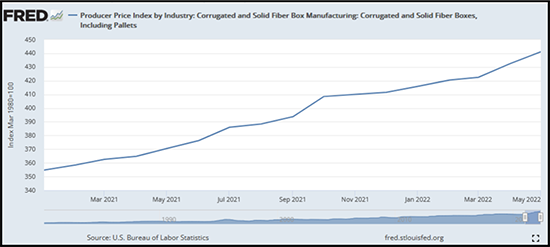

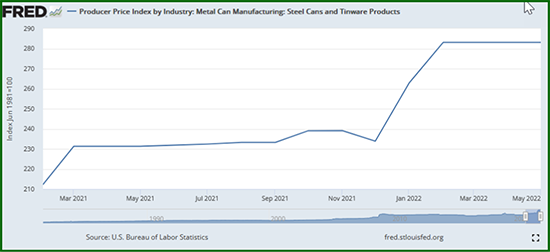

We continue to experience supply chain tie ups and commodity shortages caused by weather, the war in Ukraine, and employment shortages. We expect continued volatility of utilities, warehousing costs, transportation, packaging, labor costs and ingredients. The following graphs illustrate the continued cost escalation, of the primary components, driving our customer pricing. Ingredients continue to fluctuate, but all are generally higher. Sunflower oil is a key export from Ukraine and that tighter supply continues to drive pricing higher. Tinplate/steel cost increases drove our can costs up by over 60% this year alone!

Supply Chain

Supply chain issues still batter west coast ports and more recently, the east coast as well. Shanghai ports have recently softened their restrictions which will likely re-inundate West coast ports as we enter west coast crop-harvest and back-to-school season. Labor continues to be a challenge for transportation, foodservice, retail and food manufacturing given more folks choosing not to enter the labor force. Warehousing costs continue to rise around the country given dwindling supply and increased demand due to tariffs, “over-purchasing” to protect from shipping delays, and the growing online sales sector.

Energy:

Natural gas powers much of our production in all of our plants and California has some of the highest rates in the country. PGE is escalating rates an additional 9% minimum this year to subsidize losses stemming from catastrophic fires last couple of years, and to increase preventive measures to avoid same.

Food Inflation:

Food Inflation continues to be a global issue with more countries exploring protectionism policies, in light of global unrest and food security. This is causing supply interruptions for both exports and imports, while driving prices higher for all.

Though supplies are tight and costs are high, we are looking forward to getting our pack underway. Cherries will start in the next couple of weeks, followed immediately by tomatoes, then pears, cranberries and plums. As always, we appreciate your friendship and business and will always find a way to navigate the evolving landscape laid out before us this year. We wish you a successful season as well and look forward to getting back to visiting with you in person this year!

We appreciate your partnership!

Jon K. Holt