California Tomatoes

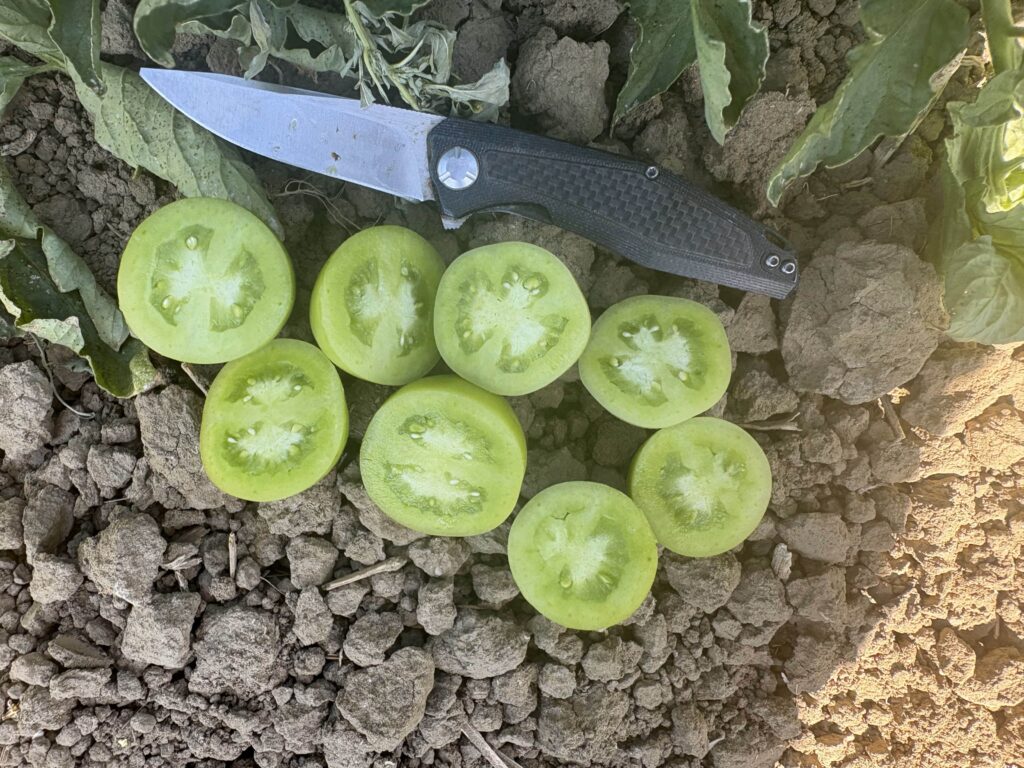

We are pleased to report that the 2025 tomato season is off to a strong start! Our planting operations experienced good weather throughout the planting process which began in March and finished at the end of May. The early plantings have developed well and are now starting to ripen for harvest in July.

As of today, our tomato crop looks to be very good throughout our growing areas which range from Kern County in the south, to San Joaquin County in the north. We’re just starting to see the first bit of color develop, and with the 90-degree temperatures coming this week, we expect to see even more green ripening to red. Thankfully, our fields have not had any issues with disease or pest pressures and our growers have ample irrigation water to successfully bring their tomato crops to harvest. As we approach the heat of summer, we keep our fingers crossed for stable summer temperatures.

Currently the USDA/NASS 2025 California Processing Tomato Report suggests a slight increase in production of about 1 percent above January, now 10.3 million tons. This is roughly 7 percent below 2024 production. The CTGA (California Tomato Growers Association) reached an agreement with processors to price at $109 per ton for the 2025 season. Additionally, late season premiums will apply and range from $2 – $17 per ton.

Pacific Northwest Fruit

Cherries:

The Pacific Northwest’s 2,500 growers expect a good crop this year based on bloom. We estimate the warm days, and cool nights will provide over 21 million boxes of cherries which is up 9% from 2024.

The Northwest will hit their July 4th target again this year, ensuring peak sales and in the meantime, NJFC is actively negotiating cannery tons and pricing.

Pears:

The quality and size of our 2023 Hood River, Salem and Medford, OR Bartlett pears look to be very favorable this year! After generous rain this winter, Medford, OR finally saw their reservoirs full again (see Emigrant Lake photo comparison below).

Hood River and Salem have good crop volume and great size heading into harvest, which started the week of August 14th in Salem. Overall, we see a strong Northwest pear crop, surpassing 2022 by at least 10-15%.

Plums:

“Final bloom drop” happened in the Salem, OR plum orchards in July indicating we’ll likely have an above average crop volume for our delicious and nutritious Italian Plums in 2023.

Fruit quality, overall, looks great and the plums are starting to change color. We anticipate a harvest of 22-2400 tons, about a 30% increase over 2022 and are scheduled to start harvest mid to late September. Inventories look strong, place your bookings now for 24/300 Retail size or 6/10 Foodservice/Healthcare product.

Pacific Northwest Berries

Oregon and Washington produce more Blueberries than any other region in the world. Oregon produces over 150 million pounds annually and Washington had a record 210-million-pound crop last year! Harvest is well underway and will continue to run into the summer months.

Marionberries are only grown in Marion County, Oregon. They are known for their sweet and tart flavor, with a firmer texture than common blackberries. Many vintners and brewers have discovered the unique characteristics of this prized fruit and work with NJFC to maximize their distinctive flavor.

Red Raspberry harvest has officially begun in the Willamette Valley and we expect it to be a good to average crop size with good fruit quality. Black and Boysen berries are estimated to have a first harvest the first or second week of July. Strawberry harvest is proceeding well with strong quality and tonnage. There are several overlapping varieties harvesting now.

We are about 3 months from Cranberry harvest, but the early bloom looks good and we expect the crop to be sound. NJFC processes all of these, along with plum, apple and pear at a variety of brix levels and in custom ingredient formulations (e.g. concentrates, essences, pomaces, etc.). Please contact John Moore (johnm@njfco.com) for more information.

Costs

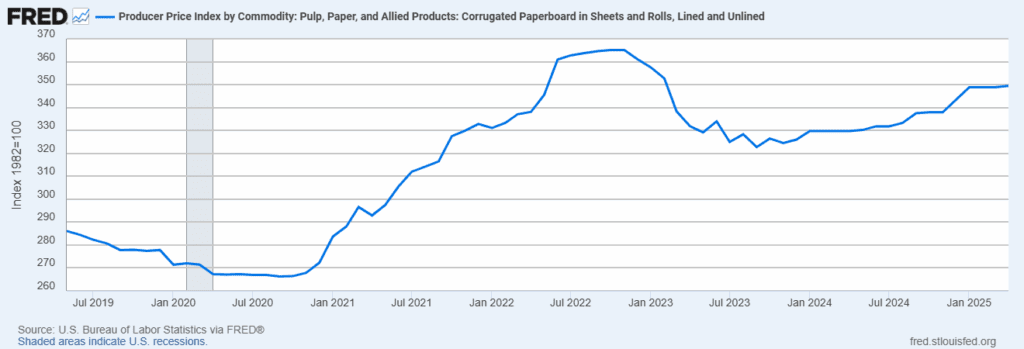

Packaging / Fiber / Labels

Over the last year, the pulp Industry has implemented 3 increases ($40/ton for each occasion) announced by PPW (Pulp & Paper) since Q1 of 2024 for 42 lb. linerboard. This has resulted in a total increase of around 14% to 15% (some corrugators pushed costs to the 17% to 20% range). Though counterintuitive to soft demand going into the year, capacity has been reduced due to some corrugate mill closures. Despite this, we have been able to keep our costs below general market trends.

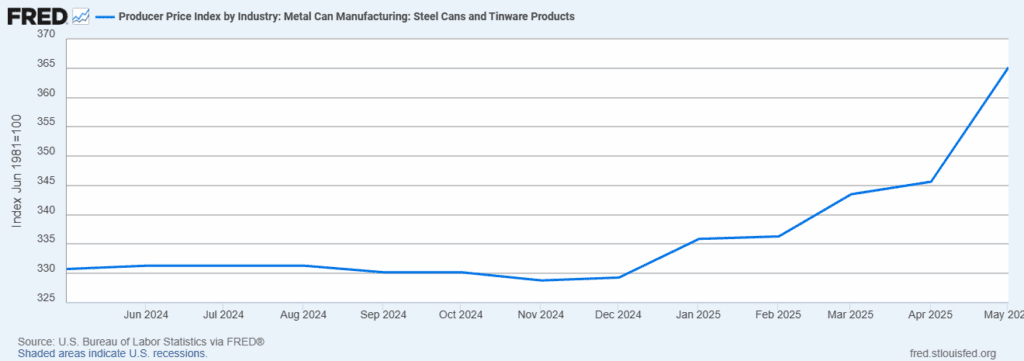

Metal Food Cans

The cost of metal food cans has been on the rise primarily due to tariffs compounded by limited domestic supply. Since Section 232 (US national security tariff actions) was enacted, along with complex quota limits for imports, capacity for domestic food can manufacturing has been drastically reduced. The US currently only has enough capacity and materials to produce around 30% of the current total food-can needs in the US.

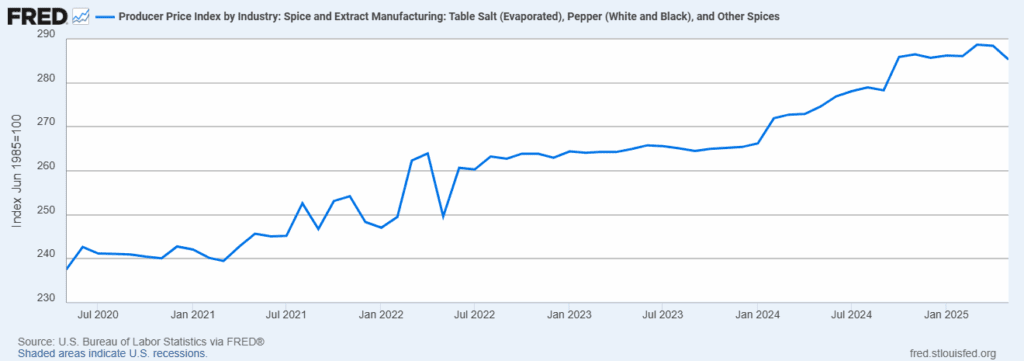

Ingredients: Spices, Extracts and Olive Oil

There costs continue to escalate and are up over 20% over the last 5 years. You may note this in your fully prepared items requiring basil, garlic, and obviously salt and pepper.

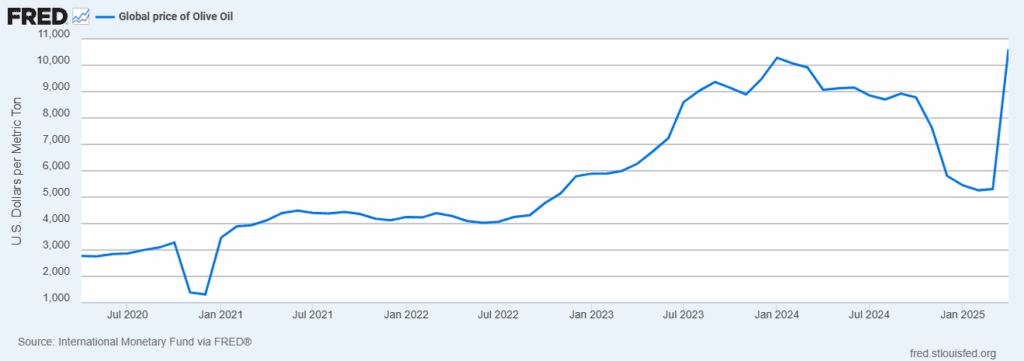

Though we’d seen some relief in olive oil pricing in 2024, pricing is again on the rise for 2025.

Production Costs/Labor/Utilities:

Additionally, and unfortunately, utilities and new wage laws continue to add to production costs:

Utilities:

The increases in natural gas from 2024-2025, driven by the “Climate Commitment Act” fee enacted in 2024, raised the cost of natural gas by 200%. From 2020 – 2025, irrespective of the CCA, the rates have gone up 64.3%; from $0.26/therm in 2020, to $0.43/therm in 2025.

- Clark County experienced an increase of 14% for natural gas during 2024 and is anticipating another 6.5-7% increase for the 2025 calendar year.

- In the Northwest, PGE regulators recently approved an increase of 7.5% for commercial customers.

- California’s push for cleaner fuel and reduced supply due to regulations and green initiatives suggests an increase of 24% from 2024 ranges for wholesale power.

Labor:

Washington State’s required minimum wage continues to rise. In 2025, an increase of 2.3% to $16.66 (up 15% since 2022) continues to drive WA processor’s costs higher.

Costs overall:

While processors welcome this season’s reduction of raw product tons, labor, utilities and warehousing costs continue to increase, particularly in California and The Northwest. The Neil Jones Food Company continues to be committed to implementing process improvement and efficiencies that offer our customers competitive pricing and optimal value for our finest quality products.

We look forward to working with you this year and seeing many of you during harvest at our three facilities!

Thanks as always for your continued support and partnership!

The Neil Jones Food Company